Europe’s decarbonization push is instigating growth in the distribution transformer market. As more renewable energy sources like solar and wind are integrated into the grid, alongside the need to power charging stations for EVs, upgrades and expansion of the distribution network are crucial. This translates directly to rising demand for distribution transformers.

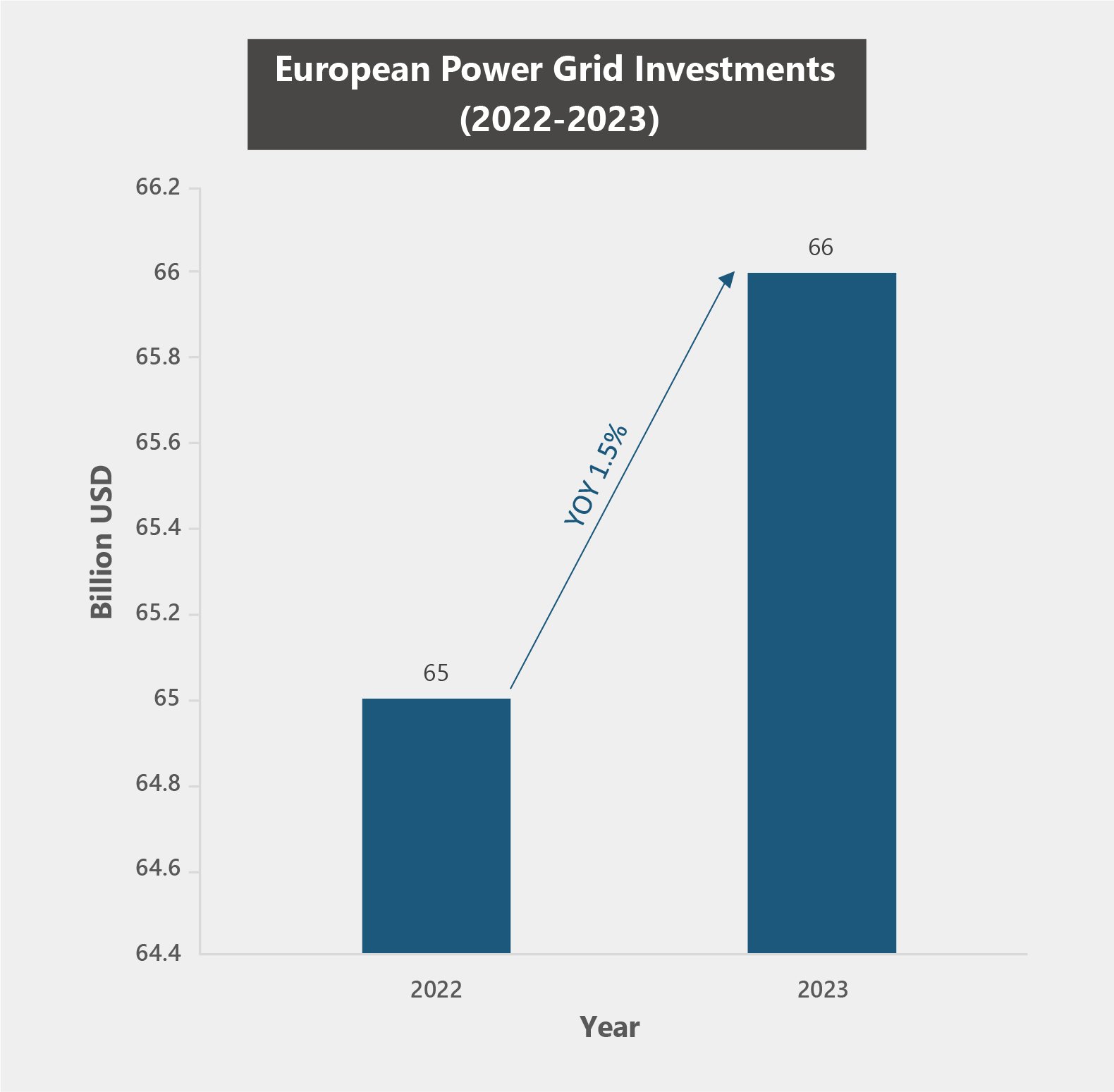

Investment for a Sustainable Grid

An opportunity for distribution transformers market growth

Europe’s ambitious decarbonization goals are driving a surge in grid investments. Integrating more renewable energy sources and building charging infrastructure for electric vehicles necessitates an expanded and upgraded power grid. Most (almost 60%) of these investments are earmarked for distribution networks. This is because a large part of Europe’s existing infrastructure, exceeding 40 years old, falls short of current EU standards. Initiatives like the Recovery and Resilience Plans (USD 13.85 billion allocated) and the EU’s “Digitalization of the Energy System” action plan (USD 633 billion investment by 2030) underscore this commitment to grid modernization. This trend will continue as Europe undergoes a major energy transition, with billions of dollars allocated for grid improvements and digitalization by 2030. These investments in the distribution networks are expected to benefit the distribution transformer market in the region.

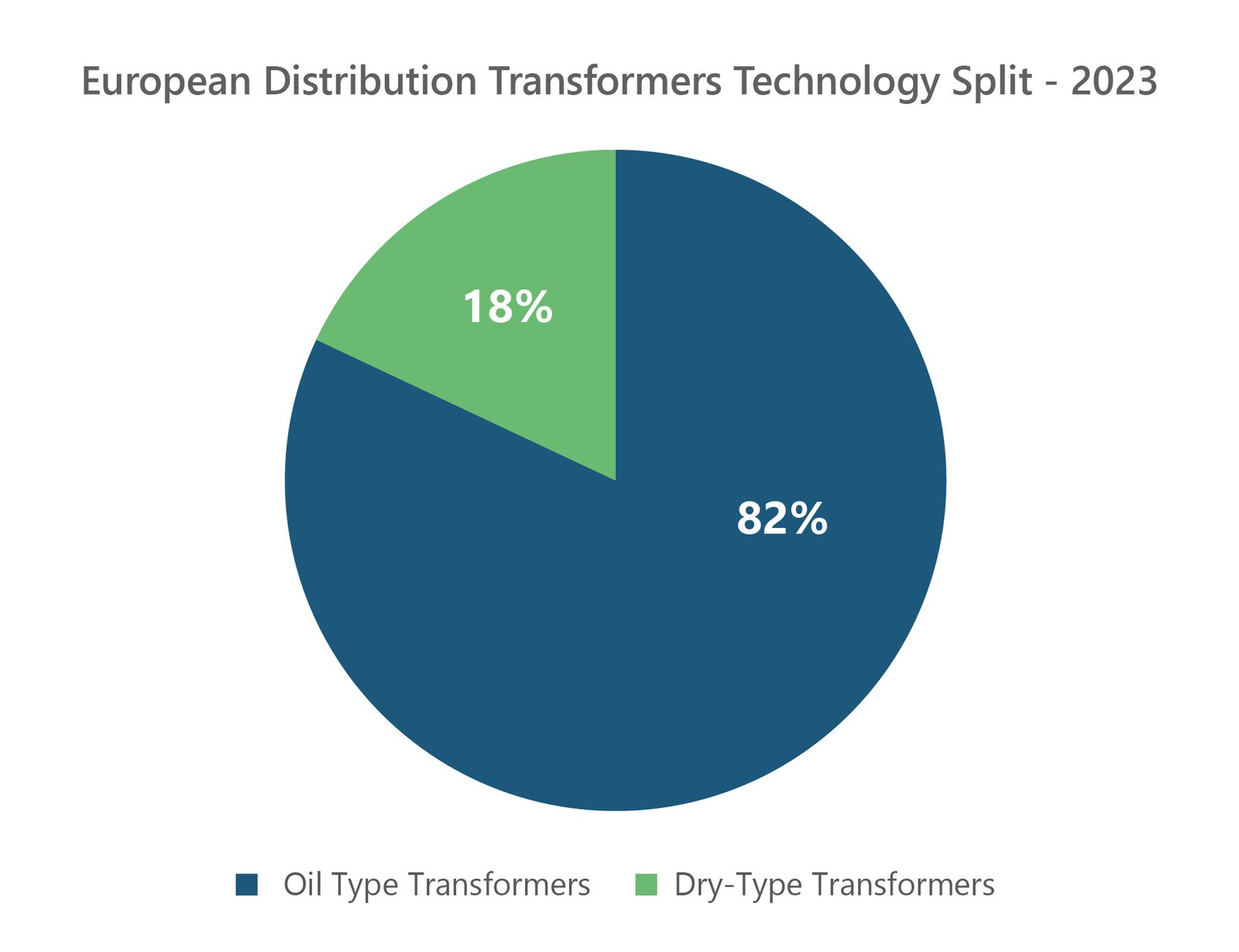

Beyond Oil-Filled Transformer: Sustainable Tech

Drives Distribution Transformer Market

- Europe’s distribution transformer market is a key beneficiary of the continent’s push towards decarbonization. With a projected Revenue CAGR of 5.5%, the market is poised for steady growth fueled by the factors discussed above.

- While oil-filled transformers currently dominate the market, due to EU regulations and environmental concerns, there’s a growing focus on sustainable alternatives. Ester-filled transformers are gaining traction as pilot projects and are expected to capture significant market share from dry-type transformers in the future. This shift towards more environmentally friendly options presents additional growth opportunities within the distribution transformer market.

Distribution Transformer Service Overview

The research presented in this article is from PTR's Distribution Transformer market research. For information about this service please submit a request shown below.

Europe: +49-89-12250950

Americas: +1 408-604-0522

Japan: +81-80-7808-1378

GCC/Rest of APAC: +971-58-1602441

More About our: Distribution Transformer Market Research

Recent Insights

Changed Energy Outlook following Georgia Run Off

President Elect Joe Biden is set to take oath on 20th January,2021, and although his win was confirmed on January 6th, the senate’s control was undecided until the recent victory of Senator Jon Ossof and Senator Raphael Warnock, both Democrats, in the Georgia run-off elections.

Climate worries pushing manufacturers away from Coal

Globally there is a growing consensus to move towards less carbon intensive power generation in a bid to tackle pollution and environmental concerns. This consensus is reflected in the decline[SS1] [KM2] of coal consumption in 2019, although there are disparities...

Transformer Anti Dumping Policies in USA: Tariffs, Executive Orders and Market Situation

The LPT vulnerability has caught the attention of the U.S. government and industry players highlighting the need for spare or reserve transformer capacity. This will enhance the robustness of the electric grid and deal with widespread transformer failures.

Bullet and weather concerns driver of retrofits in US market.

Utilities remain cognisant of physical security concerns with new orders for bullet resistance transformers.

CWIEME (Chicago) 2017 – Conference Impression

Value chain at full capacity with hurricanes and EV driving replacement and efficiency.

Chinese Dominance in Emerging T&D Markets: Pakistan’s Example

There is still a window of opportunity for non-Chinese Manufacturers.

Eskom’s Credit Rating Cut to ‘Highly Speculative’ by S&P

With Eskom’s borrowing and finance costs going up, transmission and distribution equipment markets to see a decline in South Africa.