Europe’s Switch to Sustainable Power: The Rise of Solid-Insulated Switchgear

- Environmental Friendliness: SIS presents a sustainable alternative to SF6 Gas Insulated Switchgear (GIS), aligning with increasingly stringent European regulations aimed at reducing greenhouse gas emissions.

- Space Optimization: Compared to traditional Air Insulated Switchgear (AIS), SIS offers a more compact design, making it ideal for applications with limited space availability.

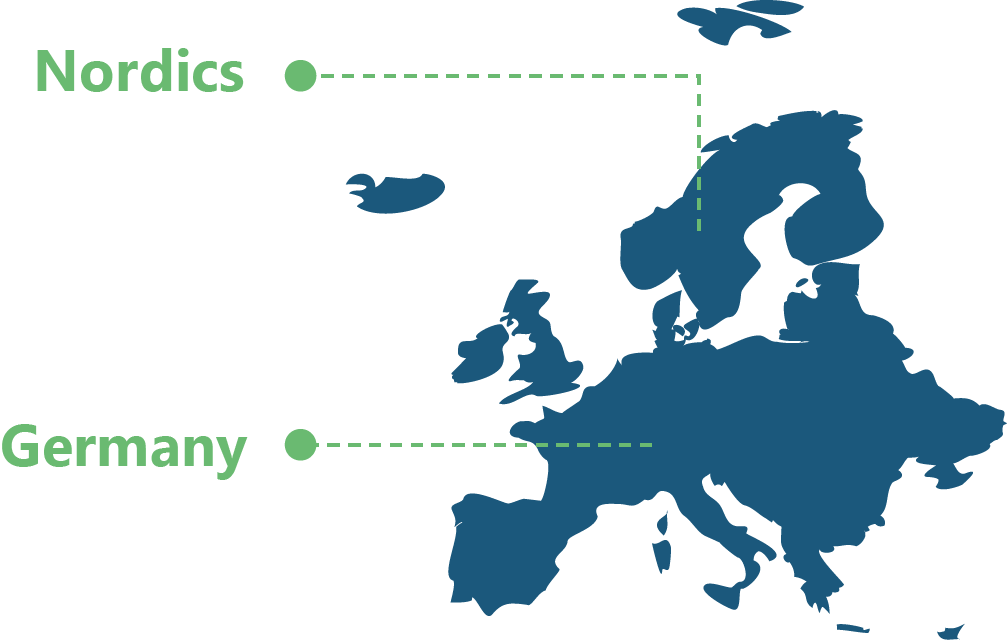

- Market Drivers: The burgeoning growth of data centers and ongoing grid modernization initiatives are serving as key catalysts for SIS adoption, particularly in regions like the Nordics and Germany.

Solid Insulated Switchgear

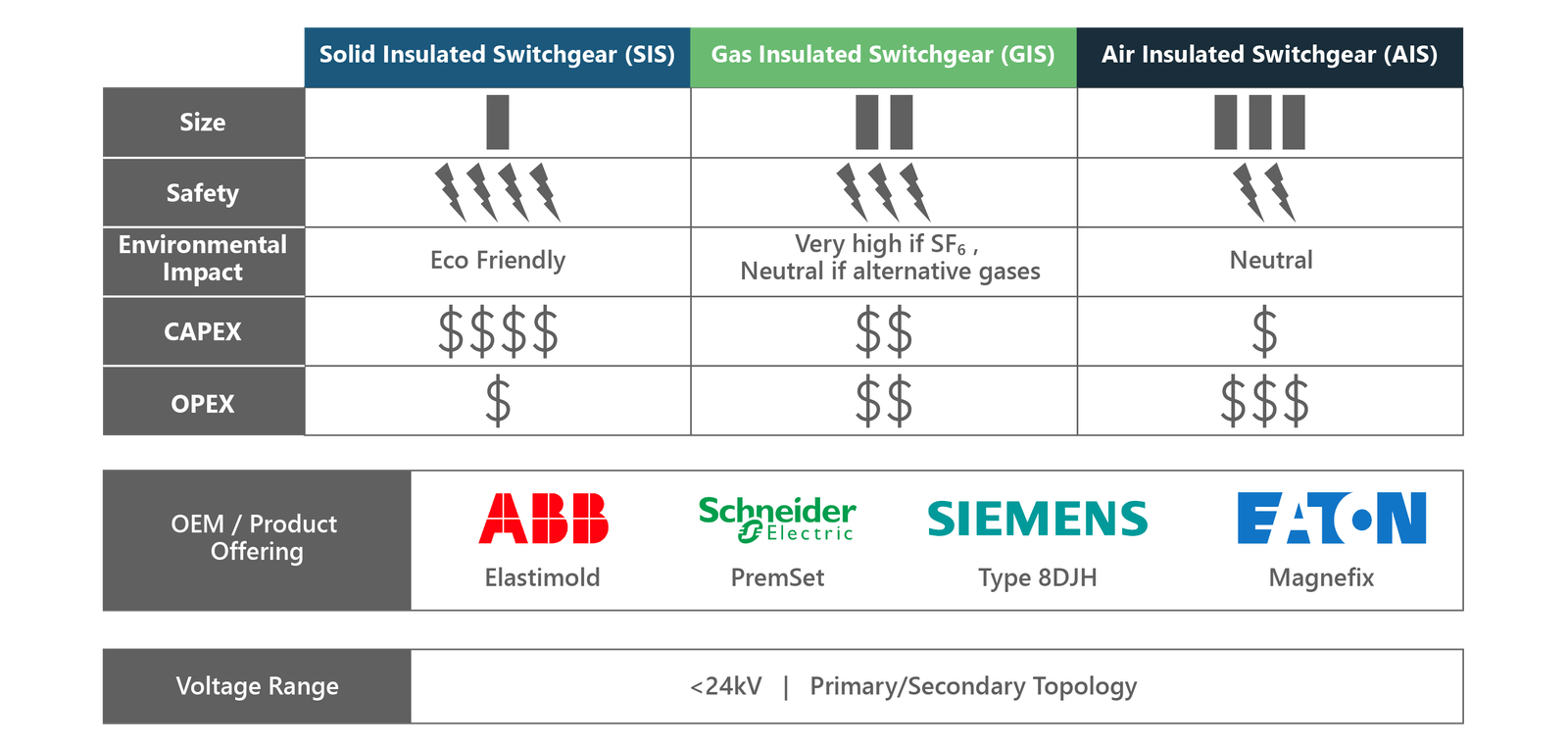

This comparison highlights the key differences among Solid Insulated Switchgear (SIS), Gas Insulated Switchgear (GIS), and Air Insulated Switchgear (AIS) in terms of size, safety, environmental impact, CAPEX, and OPEX. SIS is compact and eco-friendly, with high safety but higher initial costs and lower operational costs. GIS offers moderate safety and size, with a very high environmental impact if SF₆ is used, initial costs higher than AIS, and moderate operational costs. AIS has the largest footprint and lower safety, with neutral environmental impact, lower initial costs, and higher operational costs.

SIS Market Growth (CAGR (2024-2026)

33% Revenue

25% Units

- The SIS market is expected to grow fastest in switchgear insulation classes.

- Growth will be driven by increasing demand in the 1-24kV voltage segment.

- Higher costs of SIS contribute to a higher revenue CAGR.

MV SIS Market Dynamics in Europe

Data Center Expansion

The hyperscale data center market is expected to grow rapidly, driving demand for MV SIS.

Grid Modernization

Utilities are investing in grid expansion and modernization. SIS is preferred in areas with space constraints and where higher capacity equipment is needed due to its compact size and enhanced resiliency to extreme weather events.

F-Gas Regulation

The upcoming deadline on the prohibition on the sale of new SF₆-GIS in Europe, effective for the 1-24kV segment by 2026, will significantly impact the market. According to PTR research, many consumers are inclined to switch to SIS due to concerns about the compatibility of SF₆-free GIS alternatives.

Major Economies Driving the MV SIS Market in Europe

Medium Voltage Switchgear Service Overview

The research presented in this article is from PTR's Medium Voltage Switchgear market research. For information about this service please submit a request shown below.

Europe: +49-89-12250950

Americas: +1 408-604-0522

Japan: +81-80-7808-1378

GCC/Rest of APAC: +971-58-1602441

More About our: Medium Voltage Switchgear Market Analysis

Recent Insights

Riding the Wind: Fueling MV Switchgear Growth with Aggressive Energy Targets

A set of European countries are moving to deploy offshore wind farms in the North Sea which is expected to drive the demand for medium-voltage switchgear in the EU. This infographic sheds light on recent developments that have accelerated the shift towards renewable...

COP28’s Global Stocktake: A Pivotal Undertaking?

The global stocktake, a quinquennial undertaking, functions as a meticulous inventory of worldwide initiatives in climate action and support, with its inaugural culmination slated for COP28 in a bid to influence the ensuing round of nationally determined contributions...

COP28: Balancing Hope and Skepticism in Climate Talks

The Conference of the Parties (COP) is the primary decision-making body of the United Nations Framework Convention on Climate Change (UNFCCC). This annual gathering of member states focuses on addressing global climate change. In the lead up to COP28, amid the rising...

The EU’s F-Gas Ban Sparks Soaring Demand for SF-6 Alternative Solutions in MV Switchgear

The SF6-alternative switchgear market in Europe is poised for significant growth due to the recent ban imposed by the EU parliament on the sale of SF6 switchgear. SF6 gas, despite its widespread usage, has been found to possess a remarkably high greenhouse warming...

Overview of the European HV Switchgear Market

The High Voltage (HV)* Switchgear market in Europe has rebounded from the pandemic-induced revenue slump in 2021 and is expected to continue growing steadily until 2027.[ba_advanced_divider active_element="text" title="High Voltage Switchgear Service Overview"...

Key Drivers Instigating MV (Medium Voltage) Switchgear Demand in Middle-East & Africa (MEA)

The Middle East and Africa (MEA) region is poised for remarkable growth in the medium voltage (MV) air-insulated switchgear (AIS) and MV gas-insulated switchgear (GIS) markets. With increasing generation capacity, infrastructure projects, and electricity demand, MEA...

Solid State Technology to Streamline Global Transition to Clean Energy

The electrical power system of a country generally consists of generators, high voltage transmission lines that stretch hundreds of miles followed by distribution lines that span millions of miles in order to serve a range of consumers. Existing grid infrastructure...