Europe’s Switch to Sustainable Power: The Rise of Solid-Insulated Switchgear

- Environmental Friendliness: SIS presents a sustainable alternative to SF6 Gas Insulated Switchgear (GIS), aligning with increasingly stringent European regulations aimed at reducing greenhouse gas emissions.

- Space Optimization: Compared to traditional Air Insulated Switchgear (AIS), SIS offers a more compact design, making it ideal for applications with limited space availability.

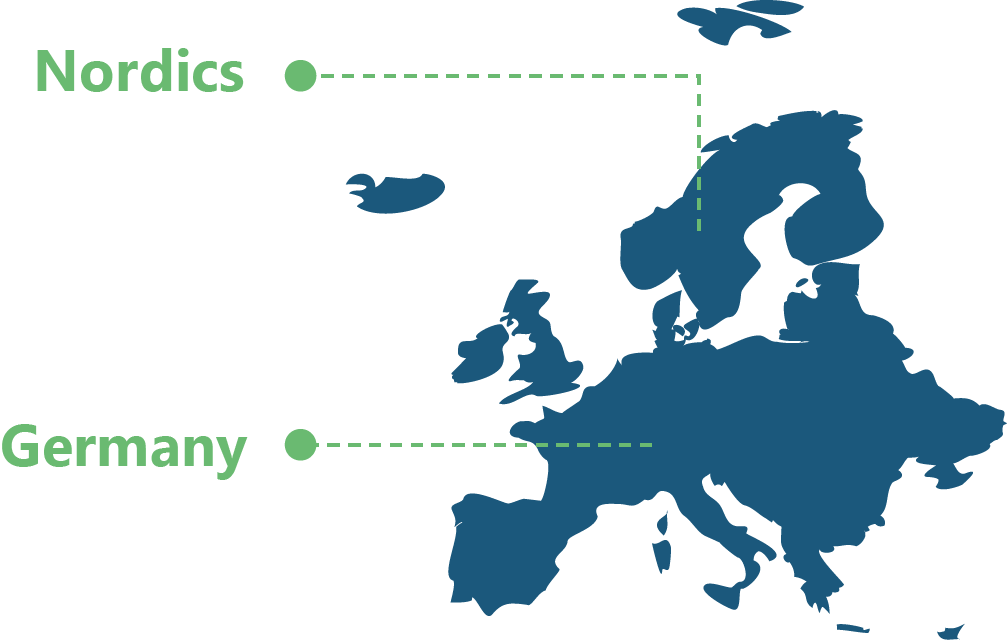

- Market Drivers: The burgeoning growth of data centers and ongoing grid modernization initiatives are serving as key catalysts for SIS adoption, particularly in regions like the Nordics and Germany.

Solid Insulated Switchgear

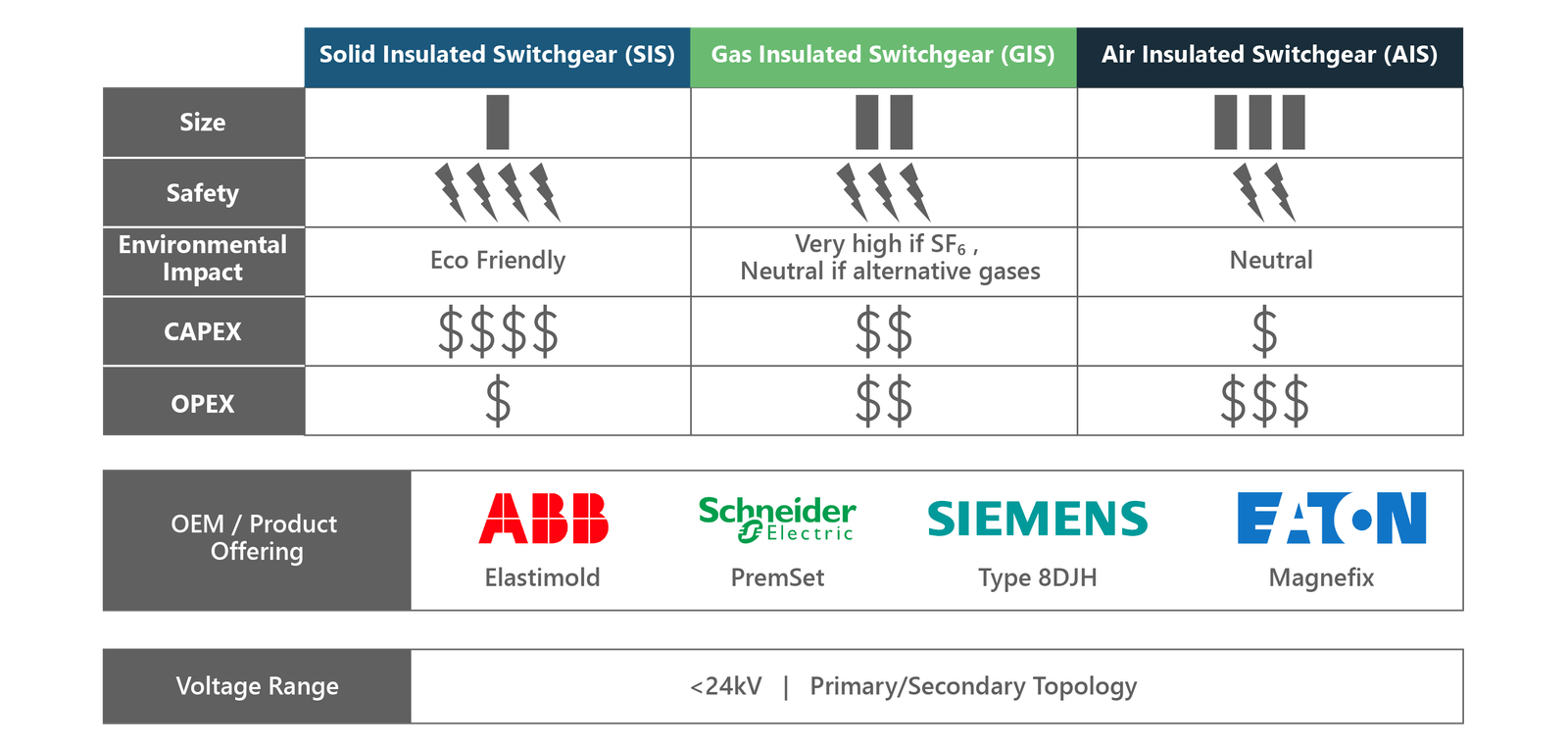

This comparison highlights the key differences among Solid Insulated Switchgear (SIS), Gas Insulated Switchgear (GIS), and Air Insulated Switchgear (AIS) in terms of size, safety, environmental impact, CAPEX, and OPEX. SIS is compact and eco-friendly, with high safety but higher initial costs and lower operational costs. GIS offers moderate safety and size, with a very high environmental impact if SF₆ is used, initial costs higher than AIS, and moderate operational costs. AIS has the largest footprint and lower safety, with neutral environmental impact, lower initial costs, and higher operational costs.

SIS Market Growth (CAGR (2024-2026)

33% Revenue

25% Units

- The SIS market is expected to grow fastest in switchgear insulation classes.

- Growth will be driven by increasing demand in the 1-24kV voltage segment.

- Higher costs of SIS contribute to a higher revenue CAGR.

MV SIS Market Dynamics in Europe

Data Center Expansion

The hyperscale data center market is expected to grow rapidly, driving demand for MV SIS.

Grid Modernization

Utilities are investing in grid expansion and modernization. SIS is preferred in areas with space constraints and where higher capacity equipment is needed due to its compact size and enhanced resiliency to extreme weather events.

F-Gas Regulation

The upcoming deadline on the prohibition on the sale of new SF₆-GIS in Europe, effective for the 1-24kV segment by 2026, will significantly impact the market. According to PTR research, many consumers are inclined to switch to SIS due to concerns about the compatibility of SF₆-free GIS alternatives.

Major Economies Driving the MV SIS Market in Europe

Medium Voltage Switchgear Service Overview

The research presented in this article is from PTR's Medium Voltage Switchgear market research. For information about this service please submit a request shown below.

Europe: +49-89-12250950

Americas: +1 408-604-0522

Japan: +81-80-7808-1378

GCC/Rest of APAC: +971-58-1602441

More About our: Medium Voltage Switchgear Market Analysis

Recent Insights

Major Movements in SF6 HV Switchgear Sector Moving Forward

SF6 gas, which has a global warming potential roughly 25,200 times that of CO2, is still the most widely used insulating gas for switchgear applications. Siemens Energy and Mitsubishi Electric signed an MoU to carry out a feasibility study aimed at the development of...

GE Establishing Itself as a Market Leader in the HV SF6-free Switchgear Market

This infographic provides an overview of the global HV SF6-free switchgear market with a special focus on General Electric who is one of the major players within this realm. Additionally, all the latest HV switchgear projects won by General Electric worldwide have...

GCC HV Switchgear Market : Enough Spare Capacity Despite Facilities Shutdown

As of 2020, the HV switchgear market of GCC countries accounts for 5% of the global HV switchgear market in terms of revenue. In GCC’s HV switchgear market, Saudi Arabia holds the largest market share which accounted for 40% of the region’s total revenue in 2020....

Evolution of Digital Switchgear Product Portfolios

Switchgear which is complaint with IEC 61850 (ethernet-based communication protocol) is known as digital switchgear.

Competing during Transformation: How Private Equity firms are Utilizing Market Research in Energy Sector

70% of the PE firms in Europe are actively outsourcing, while the figure stands at 30 to 40% for the US.

EMEA MV Switchgear Annual Market and Competitive Landscape

In Europe, AIS and GIS contributed equally to the market, whereas in MEA, AIS is clearly dominating.

Foreign electrical equipment suppliers in hot water as USA issues an executive order

Equipment suppliers cannot be sure about their market positioning.